Property Legal Service for Foreigners / Expats : Buying Property in Thailand, Buy House Thailand, Real Estate Investment Thailand — How to Invest / Buy / Own Thai house, Condo, Villa, Apartment, Property Bangkok Thailand, legally & safely [Bangkok, Pattaya , Phuket – Patong, Huahin, Chiang Mai, Udon Thani, Koh Samui, Krabi] by Licensed Property Lawyer & attorney

>>> Escrow Account for Real Estate & Property Purchasing | Buy Thai Property | NPA Asset Investment | Thailand Visa & Immigration Services | Family Law & Estate Management | Dispute Resolution on Property Matters?

Thailand Property & Legal Services for Foreigners and Expats

If moving to Thailand, Investing – Buying – Owning the Thai house, Condo, Villa, Apartment, Property & Real Estate ,or Investing business in Thailand is what you plan, House & Condo Lawyer (Property licensed Lawyer Team in Thailand), having experience and expertise in both local real estate business and laws, can provide you the one-stop-service solution, making your plan go smooth like Thai Silk.

House & Condo Lawyer consists of property lawyers & real-estate business team with more than 15-year experience, who are promptly to assist you at your extensive requirements with the reasonable fee. Since your goals are our achievements so, you can rest assured that with our services, every of your requirements will be attended and responded to your best benefits with our sincere expert’s advises all and about the world of real estate business and property laws.

YES, We have Lawyers & Teams at PHUKET, PATTAYA, HUAHIN, CHIANGMAI, UDON THANI, BANGKOK, ETC. !!!

In the following article, we will explain to you, as a foreign national, the legal aspects of owning and possessing real estate in Thailand, including land, houses, villas, condominiums, apartments, and other structures. Our goal is to ensure that your investments are secure and fully compliant with the law, safeguarding you from real estate fraud and other potential risks.

If you still have questions or find the content too lengthy to fully grasp, please do not hesitate to seek legal advice from our experienced property lawyers. We can provide guidance on the applicable laws and the most suitable methods of real estate ownership tailored to your investment needs.

Our Services

- Property Living & Consultant in Thailand

- Property & Real Estate Legal Services (English Speaking)

- How to own / invest the real estate in Thailand, 100% Legally

- Due Diligence for Property Transaction : Buy – Sale – Rent etc.

- How to buy/invest “NPA Assets” of Financial institution (20-40% Cheaper below market price)

- Property / Real Estate Fraud Lawsuit in Thailand

- Property Contract Review (start 5,xxx Baht/Contract for a common condo/villa)

- Escrow Account in Thailand for Real Estate & Property Purchase Transaction, or Lawsuit (Our Service fee : 0.5% of the transaction)

- Thailand Visa & Immigration Services

- Refund Property Downpayment from the Property Developer in Thailand : Condominium Unfair Contract, Delay & Poor Construction, EIA not pass, or even change your mind not to buy!!

- Business Match Maker & Consultant : Experience & Expertise in Real-estate, Hotel, Information Technology, Commercial & Medical Business

- Business Registration and Corporate Services

- Accounting & Tax Planning

- Relocation Service for Foreigners / Expats

- Family Legal Services : Marriage Registration. Prenuptial Agreement, Filing of Contested and Uncontested Divorce, etc.

- Last Will and Testament

- Notary Services

- Translation and Legalization Services

- Consumers Rights Protection Lawsuits

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

- Property Legal Service for Foreigners / Expats : Buying Property in Thailand, Buy House Thailand, Real Estate Investment Thailand — How to Invest / Buy / Own Thai house, Condo, Villa, Apartment, Property Bangkok Thailand, legally & safely [Bangkok, Pattaya , Phuket – Patong, Huahin, Chiang Mai, Udon Thani, Koh Samui, Krabi] by Licensed Property Lawyer & attorney>>> Escrow Account for Real Estate & Property Purchasing | Buy Thai Property | NPA Asset Investment | Thailand Visa & Immigration Services | Family Law & Estate Management | Dispute Resolution on Property Matters?

- Thailand Property & Legal Services for Foreigners and Expats

- Our Services

- It’s Time to move to Thailand!

- Foreign Ownership Restrictions for Condominium, Land and House in Thailand

- Foreign Ownership Restrictions for Land

- Foreign Ownership Restrictions for Condominium

- Foreign Ownership for House—Structure / Building

- How to Invest & Own the Thai Real Estate for Foreigners / Expats : Land, House, Condo, Villa, Apartment

- 1. Purchasing & Owning Condominium in Your Name

- 2. Registering the Long-term Lease at the Land Office

- 3. Purchasing the Real Estate Through a Thai Company

- 4. Marrying A Thai Citizen

- 5. Registering the Right of Usufruct

- 6. Registering the Right of Superficies

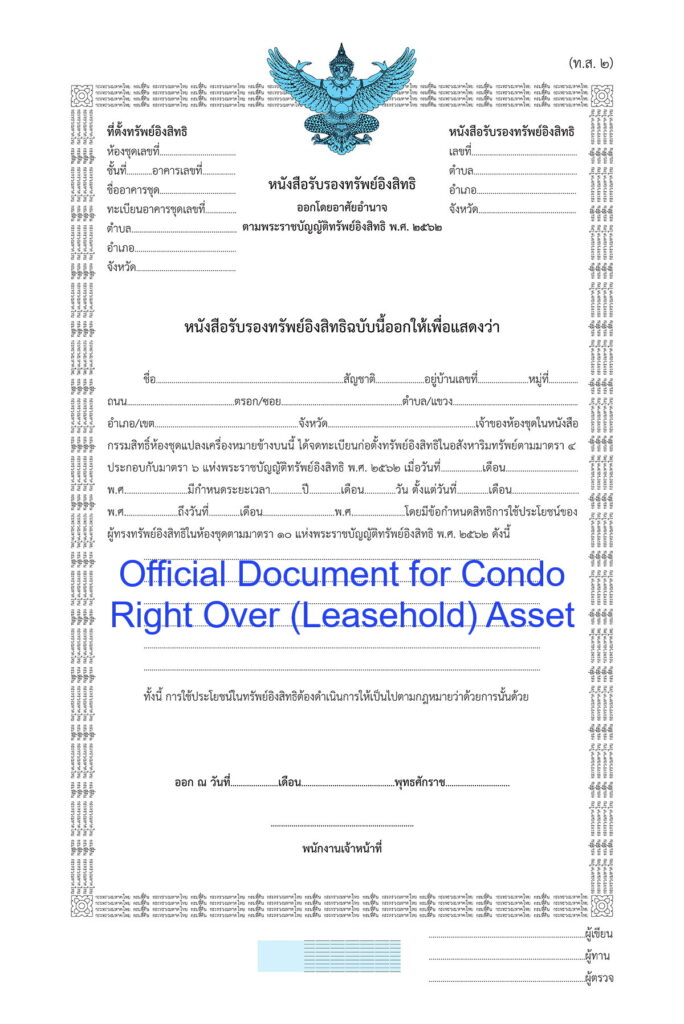

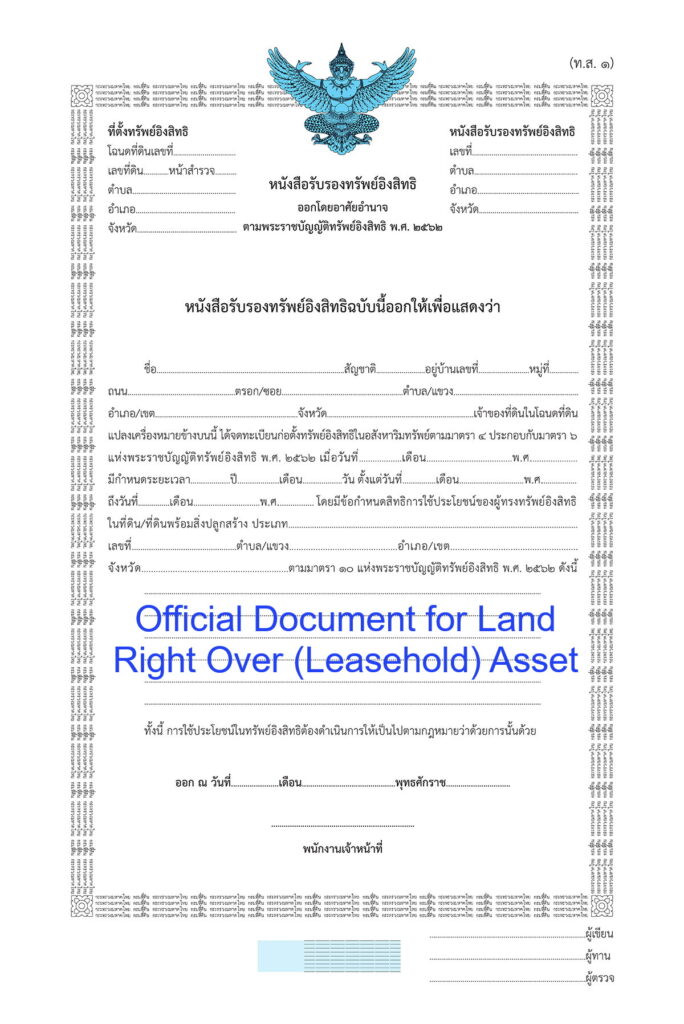

- 7. Establish the RIGHT OVER (Leasehold) ASSET New!! Legally owning Land & Property in Thailand with the substitute Title Deed!! (RIGHTS OVER LEASEHOLD ASSET ACT B.E.2562)

- Important Facts About the Right Over (Leasehold) Asset.

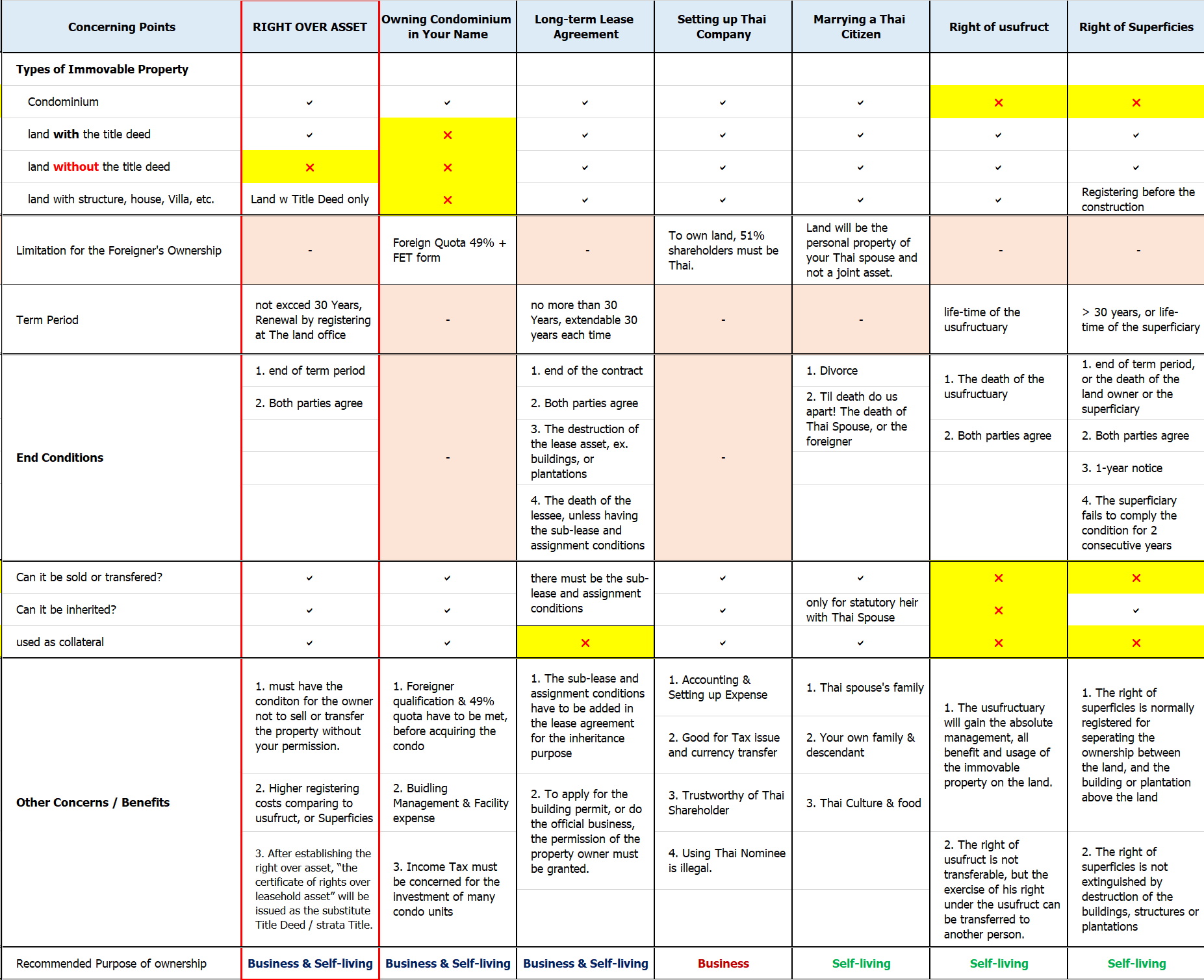

- “RIGHT OVER (Leasehold) ASSET” vs Other Options for the Foreigner owning Thai Property

- Challenges in Buying & Owning Real Estate in Thailand

- Enforcement and Punishment Measures in Land Holding as an Agent for a Foreigner

- Why should you hire “House & Condo Lawyer” as your professional real estate lawyer in Thailand?

- Our Lawyer Team

HOT!! Do you know RIGHT OVER ASSET (RIGHTS OVER LEASEHOLD ASSET ACT B.E.2562) ??? Let the foreigner own the property in Thailand with the substitute title deed!!

It’s Time to move to Thailand!

Why does Thailand become one of the world’s best favorite destination for Long-Stay, Retirement, Property Investment, and living as a second-home country for many people?

- One of the world’s best Climate’s position, Thailand offers tropical humidity climate with shower rain and some seasonal monsoon, no frozen cold or snow, not in the earthquake earth’s plate, no volcano or heavily major impact from large scale of storm, and no on – land tornado (typhoon).

- Thailand promotes tourism and recreation with vary tropical sceneries; mountains, beaches, agricultural lifestyles together with urban lifestyles with advanced infrastructure and stable Hi-speed wifi.

- Thailand is one of the biggest world’s kitchen at reasonable and affordable prices for all, with fresh and recognized food’s tastes. Also, with the more diversity of the food nation, Thailand is the place that you can find all food cultures around the world along with the famous Thai dishes (Som-Tam, Tom Yum Goong, Massamun-kai, Green Curry Soup) like western food, eastern food, Chinese food, Japanese food, Korean food.

- Thailand ranks the country of cheaper price of living standard; Bangkok ranks 350th place, followed by Phuket at 384th place, Chiangmai at 395th Place and Pattaya at 395th place from all of cities in the ranking survey of 578 cities worldwide.

- Thailand do not have high rates of racism, religious or believes discrimination that may develop to violence conflicts. However, the political conflicts among Thais are always within the social norms which never develop to any long extreme violence. With compromised and friendly characters of major Thai nationals, it is not easy to see violence extremists.

- Among its world-class medical facilities, Thailand has the largest number of private hospitals anywhere in Asia. In addition, as a result of its large and well established medical-services industry, there is also a correspondingly large market for medical devices in Thailand.

- Year 2022, Bangkok ranked no.1st best city in Southeast Asia and also ranked 2nd place of the world’s best city, and Asia’s best city for digital nomads.

- Phuket ranked no.1st island in Southeast Asia, Ko Samui ranked no.2 nd and Ko Phi Phi ranked no.9th from the inaugural’s Asia’s Best Awards’, Travel+Leisure Southeast Asia. Chiang Mai also become on list of Top 10 best cities in Southeast Asia at no.6 th.

Tropical Paradise is calling? After a holiday vacation in the land of smiles, Thailand, many visitors from other countries always came up with a thought about having a piece of this tropical paradise of their own for many great benefits.

From the last 20 years, Thailand becomes popular destination for foreign investment on Property due to its holiday paradise of Asia reputation. However, there are some failures fore-told in acquiring property in Thailand that made the loss to the investors due to lack of correct information

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

Foreign Ownership Restrictions for

Condominium, Land and House in Thailand

By Thai Laws, foreigners are not allowed to own the land in Thailand. Under the Land Code Acts, but there are legitimate exceptions for foreigners to obtain the ownership over land and house in Thailand. Foreign ownership for condominium units within foreign quotas are granted under the Condominium Acts.

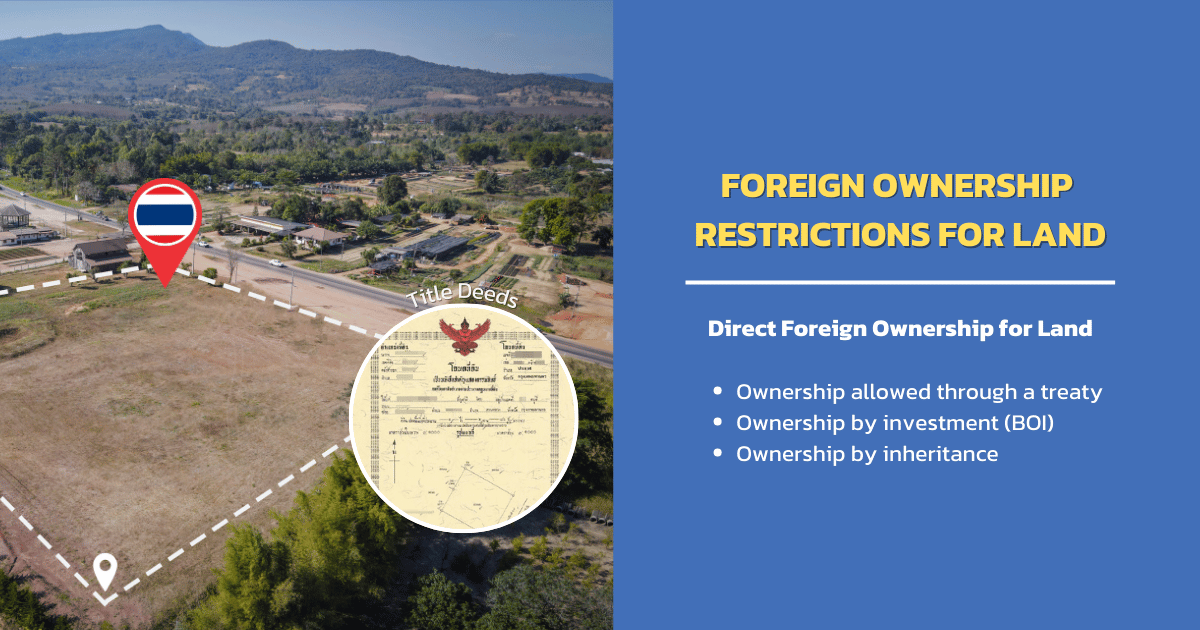

Foreign Ownership Restrictions for Land

- Ownership allowed Through a Treaty : The Land Code Act, B.E. 2497 (1954) as stated under Section 86 : “Aliens (Foreigners) may acquire land by virtue of the provisions of a treaty giving the right to own immovable properties and subject to the provisions of this Code. Subject the Section 84 the aforesaid aliens (Foreigners) may acquire land for residence, commerce, industry, agriculture, burial, public charity or religion under the conditions and procedures prescribed in Ministerial Regulations and with the permission of the Minister.”

Thailand has currently no treaty with any country allowing a foreigner to acquire land in Thailand. - Ownership by Investment: Under section 96 bis Land Code Act added by Land Code Amendment Act (No. 8) B.E. 2542 (1999), a qualified foreigner who qualifies under section 96 bis of the Land Code Act is required to do the investment of not less than 40 million Baht in Thai bonds and assets, approved by the BOI (Broad of Investment), which must be beneficial to Thai economy and requires approval by the Minister of Interior. The foreigner may own up to 1,600 square meters (1 rai) of land for residential purposes in specified areas. The foreign land ownership under section 96 bis is limited to the life of the person granted the right to own the land (not transferable, not inheritable). Permission for foreign land ownership under section 96 bis Land Code Act is rarely applied for or granted.

Board of Investment (BOI) section 27, Investment Promotion Acts, under section 44, Industrial Estate Authority of Thailand Acts, section 65, the Petroleum Acts. Stated the exemption for large business investment approval of land ownership with limitation during the business period.

On 8th August 2022 the Board of Investment (“BOI”) issued its Announcement No. 6/2565 Re: Criteria for Granting Land Ownership to BOI-Promoted Foreign Juristic Persons for Office and Residential Use. The BOI-promoted foreign juristic person must have the paid-up registered capital of not less than THB50 million. It can be eligible to the holding of ownership of the land for:

> The office location must not exceed 5 rai (8,000 square meters)

> The residential buildings for executives or experts must not exceed 10 rai (16,000 square meters)

> The residential buildings for employees must not exceed 20 rai (32,000 square meters)

> The land ownership must be disposed of within 1 year after the BOI promoted person status expires or is withdrawn.

The BOI may issue additional terms and conditions as it may find appropriate, such as the types of businesses that are eligible and the distance between the business location and the land to be owned under this announcement if they are not located in the same location. - Ownership by Inheritance : Under Section 93 of the Land Code Act, a foreigner, as a statutory heir, can have an ownership in the inheritance of land upon a permission of the Minister of Interior. But such acquisition, when added to that which is already held may not exceed the amount which may be held under Section 87, 1 Rai (1,600 square meters), for residential purpose only.

Beside the direct foreign ownership mentioned above, to buy / invest / own Land in Thailand, many Foreigners usually do: - Registering the long-term lease agreement

- Purchasing Land Through a Thai Company

- Marrying A Thai Citizen

- Registering the right of usufruct

- Registering the right of superficies

- Establishing RIGHT OVER (Leasehold) ASSET – NEW Law! The substitution of Title deed!! For the foreign ownership!!

As several options to acquire property in Thailand vary by type of property and purpose of usage, for housing, investment, families, immigrants, etc.

Thai laws mandated the rights over property to be officially registered. Without an official registry, which is normally done at the Land Department, asset ownership may not be secured by laws.

Always seek legal consultation and services from reliable lawyer who knows property acquisition that leads you to completion of registry to protect your interests.

Foreign Ownership Restrictions for Condominium

Foreigner can freely own condominium in Thailand, the Condominium Act states the right of ownership for non-Thai citizen. So, it is legally binding all process of your condominium purchase if you do not have the citizenship. However, there are special checklist for the ownership registration. There are more than just language barriers but also some specific documents required and interviews by officials.

Condominium building unlike the apartment which the whole building may own by a particular owner and lease out apartment units to tenants. However, Condominium is a project compile with one or more buildings; it can be low-rise as up to 8- stories or high-rise sky tall building, and each units of the condominium are owned by individual owners, they will share the facilities and common area of the whole projects as co-owners which they are also responsible for expenses of using and maintaining these facilities and common area as duties to the residents of the project as taking care them as personal property.

The facilities and common areas usually consists of utilities and amenities such as lobby, drive way, hallways, corridors, exercise room, swimming pool , sauna, library, laundry room, sporting area, garden, elevators, water, electricity, trash disposal service room, etc. The management and services costs for all these are managed under the “Condominium Juristic Person” which works under the management board of the committee, which co-owner (individual owner of the units) can vote to select the committee and represent them at the management board to supervise the performance of “Condominium Juristic Person”, that runs by the budget of the common & facilities fees that paid by each individual units owner. As enforced payment by law and regulation over Condominium Juristic Person. (Yes, the common fee or facilities expense will be the owner’s regular yearly expense; not paying it for a long time can cause the loss of the condo ownership.)

Foreign Ownership Quota (49%) : By previous law of Foreign ownership Quota in Thailand, only upto 40% of the proportional calculated space of the whole building area was granted for foreign owner under the Thailand Condominium Act in the 90’s. However, there are developments of the regulation to entertain more foreign ownership over condominiums, and now up to 49% for non-Thai ownership vs. Thai ownership.

Foreign Ownership Qualification: There are also some checklists to see qualifications required for non-Thai citizens to own property in Thailand. However, if all the documents required are well provided and the individual is qualified. Under the condominium act, the foreign owner can register the ownership using his or her name as solo owner of the property.

Thailand Condominium Act, section 19, Foreigner and Juristic persons may have ownership over the units in the condominium project per following:

- Non-Thai Citizens are allowed to reside in Thailand under Thai immigration law.

- Under Thailand Investment Promotion Law gives conditional permission for non-Thai citizens

- The registered Juristic person under Thai law

- Under the Investment Promotion Law, the non-Thai citizen juristic persons with the National Executive Council and received the promotion certificates.

- Non-Thai citizens or juristic persons who have taken in foreign currency into the country or withdrawn cash from personal Thai bank account outside Thailand or by foreign currency.

Section 19(5), non-Thai citizen to purchase condominium in Thailand must present the monetary transaction into Thailand with Thai Baht converted through a licensed financial institutes or Banks.

Foreign Ownership for House—Structure / Building

Generally, foreigners cannot own land in Thailand, but they are allowed to lease the land or to establish the Right Over Asset, registered at the land office. And they can own the house / building, or structure constructed on the land.

Ownership documents for the house / building: land has a title deed document, but, in Thailand, a house/building does not have an ownership document. Many foreigners believe the tabien baan or the house registration document can be the house/building ownership document, but this is wrong. Proof of ownership can be:

- Lease Agreement giving the lessee the right to build, and the building permit (preferably issued in the lessee’s name)

- The building permit and The document of Right Over (Leasehold) Asset

- The Thai script sale of a structure document, issued, signed, stamped and administered by the local land office

- By registration on the land title deed, the right of superficies

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

How to Invest & Own the Thai Real Estate for

Foreigners / Expats : Land, House, Condo, Villa, Apartment

For the foreigners / Expats to invest or own the property in Thailand, the usual methods are as follows:

1. Purchasing & Owning Condominium in Your Name

As mentioned above, despite of the difficulty in owning land property in Thailand, there is a legal way under the Condominium Act regarding property ownership of this type of real estate to buy and own the condominium units under the foreigner’s name in their strata title (the document of condo ownership—”Aor”Chor 2” in Thai). It is quite common practice for foreigners to take this opportunity to be able to own real estate in Thailand and many condo buyers use it for purposes like residence or investment within the private sector

According to the Condominium Act mentioned before, there are two major concerns on foreign condo ownership.

- Foreign Ownership Quota of the condominium must not exceed 49%. This is calculated based on the area of the condo and all units.

- The foreign currency is required for the payment of the condominium of the Foreign Ownership. It must be transferred into Thailand and converted into Thai currency (Baht). For large foreign currency transactions, a Foreign Exchange Transaction Form (FET form) will be required and used in registering ownership at the land local office. Make sure that the money transfer comes from a foreign account in the buyer’s name or is transferred to an account in the buyer’s name. If you bring in cash, make sure to get a receipt showing this from customs. If you are married and purchasing joint property, make sure the transfer is in both of your names.

A Foreign Exchange Transaction form (FET form)

The document required for the official registration of the ownership of the condominium purchased by a non-Thai citizen is the FET form (or TOR TOR 3)—Foreign Exchange Transaction Form. It is required to present the original copy issued by authorized financial institutions under the Bank of Thailand and the Board of Investment Regulation, which directed that any foreign currency exchanging that exceeds 50,000 USD equivalent at any currency must provide a FET form to show the official report of such transaction to the Bank of Thailand.

FET form must show the name of the buyer, saying the transaction purpose for purchase of particular condominium as the foreign buyer’s name as receiver or sender, the register ownership at the land department with the same name as evidence required for non-Thai register practice under section 19 ofThai Condominium Act.

Any exchange foreign currency into Thai Baht (THB) under 50,000USD equivalent does not required for FET (TOR TOR 3) but, non-Thai citizen may request letter of confirmation for such foreign transaction converted foreign currency into Thai Baht (THB) through the Thai Bank. This required for registry at the land office.

Caution! The use of fraudulent FET forms is strictly prohibited. The issuance of an FET form must be carried out in compliance with proper procedures and must clearly state the purpose of the transfer from the originating country. The process must also be handled through a bank in Thailand, specifically at the bank’s headquarters or a specialized branch. Due to the complex procedures involved, there have been cases where dishonest real estate agents or third parties have engaged in the forgery of such documents.

There have been instances where fraudulent real estate agents or third parties have engaged in the forgery of these documents. If such forgery is detected after the transaction, the transaction will be voided, and there is a significant risk of criminal prosecution for document forgery and making false statements to authorities. You may also be deemed an accomplice

If the FET form issuance did not follow the correct process from the originating country, you should suspect that the document is indeed fraudulent. Always ensure that the documents you receive are verified with the issuing bank to confirm their authenticity.

2. Registering the Long-term Lease at the Land Office

The long-term lease is an alternative to owning the real estate in Thailand, and a foreigner can lease it for 30 years, with an additional extension of 30 years after the original lease term ends through the agreement contract. While this is not outright ownership, this is a very popular and preferred way for owning land or land with the building (House, Villa, Apartment, building) as a foreigner in Thailand.

For lease agreement more than 3 years rental period must be registered at the land office over the territory of the property to be enforced the right of tenancy by law of Thailand that apply for all real estate/non-movable assets ; Land , House, Villa , Condominium unit or commercial property and else. Under Thai commercial and civil law code section 537 – 571, allow the lease agreement on property upto 30years at each period of lease agreement which applicable for all nationalities.

Alternatively, you can do the long-term lease for only the land, whereas the ownership of the building (house, villa, shophouse, other construction) is belong to you or the foreigner (land lease and ownership of the building). This can lead to a stronger position of the lessee.

The limitation of the long-term lease

- Transfer of ownership of the property does not break the lease agreement (section 569), but it does not prohibit the owner from selling the land / real estate.

- A lease agreement in essence creates for the lessee a personal right of use and possession. The death of the lessee will end the poorly-drafted lease agreement, irrespective the terms, except having the sub-lease and assignment conditions in the lease agreement.

The tenancy right is the individual rights set by contract between individuals, it cannot be inherited. Once the person is dead, the tenant’s position of the tenancy contract is also ended. Except, there are clause of exemption that both landlord and tenant in the contract has been agreed and stated in the contract that both accept for “Sub-lease and assignment” then, the lease contract may carry on as inheritance after the death of the persons. According to Thai Supreme court ‘s verdicts no. 2939/2559 and no. 11058/2559. - The degeneration of the building or the construction will end the lease agreement for the building, but the land. Establishing the Right over asset, registering the right of usufruct or the right of superficies will secure your ownership right of the building (house, villa, or any construction above the land) more than only the long-term lease agreement.

- The legitimated lease contract term coverage by law of Thailand, under the commercial and civil code law, the lease contract term period length can be up to 30 years, any agreement that provide longer period term will be enforced only 30 years period (section 540) after 30years, the renewal of the contract is required.

- The Renewal condition of the lease agreement are personal contract promises. They are not automatically binding on any transferee owner or successor of the property.

3. Purchasing the Real Estate Through a Thai Company

Setting up a private limited company is quite a considerable alternative for the foreigner to invest in, or to own the real estate in Thailand. Because of the TAX issue and money transaction, this option is suitable for the commercial property, many real estate units for rent (and making profit through sale later), and some cases for self-living. And if you want to do your other business, seriously, in Thailand, setting up a company will be a “must” option.

To own the land, Thai shareholders must hold at least 51% of the company’s share in order to treat as Thai Company, not foreign corporations. Thus, as a foreigner, you generally cannot hold more than 49% of the company’s shares.

In case of needing the Thai individual holding 51% of the shares of the company, you have to make sure that he/she is trustworthy for you. Some irresponsible lawyers, or real estate agents may advise you to use the nominee (or agent) that they will find or be the one for you. Please note that this is illegal in Thailand.

They, and also some foreigners living in Thailand, may say that there is no problem in using the Nominee (or agent) holding your property, or your company’s share. They have done in this basis for a lot of cases, and there are still no any problem issues. But the government, by Interior officials, do checking, randomly. The investigations happen on a case-by-case basis.

The longer time, the more frequency of the investigation and more dangerous of using the Thai Nominee (Agent) will be. If it appears the fact last that there is the threat of land holding as an agent for a foreigner, the measures to the land disposal (Section 94 and 96 of the Land Code), and the offender punishment (criminal code section 267), shall be enforced, affecting your asset and investment in Thailand. Moreover, in case, if the nominee holding your property, or your company’s share, involves in money laundering from other offenses, ex. drag, fraud, and pony share, your property can be seized and investigated, and may lead to your arrest warrant in Thailand. So, please be careful!!

For the foreigners who are using the Thai Nominee (Agent) to hold the company’s share, land or property in Thailand for you, we strongly recommend you to change into the legal methods. One of the solutions to solve the nominee issue is to use the trustworthy holding company instead of Thai individual, and/or establishing the right over asset of the real estate in your name.

Please consult our property lawyers for more details and options!!

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

The limitation of Purchasing the Real Estate Through a Thai Company

- Accounting & Document expense: Thai companies have to prepare their financial statement at least once in every 12 months and has at least one auditor.

- 51% Thai-owned shareholder in order to own the land

- Untrustworthy Thai shareholder can cause your serious problems, and lost in the property & money.

Using Thai Nominee (agent) is illegal!!

4. Marrying A Thai Citizen

Finding Thai spouse or your destined one in Thailand also let the foreigner own the real estate through his/her name. Besides other assets & property, the foreigner or the foreign descendants with his/her Thai spouse, as statutory heir, can also have ownership in the inheritance of land for their self-living under section 93 of the Land Code Act.

For the land, you, as the foreign spouse, have no ownership. The land title deed cannot be registered under your name, but it will be the personal property of your Thai spouse and not a joint asset between husband and wife based on marital property laws. since only Thai citizens are eligible to legally own the land.

The married couple has to present to the land department at registration that the money used for the land purchase is personal property of the Thai spouse per Commercial and Civil code law section 1471 and 1472 and/ or supply a land office official certify letter stating that the money spent on land is separate property (Sin Suan Tua) or personal asset of the Thai spouse, not jointly owned property (sin som ros) between husband and wife.

However, upon the termination of marriage or divorce, the problem can occur. As the personal property of the Thai spouse, he/she has sole ownership of the property. Thus, it is not subject to an equitably division between husband and wife.

Possible Solutions in case of Divorce

- Establishing a right over the property or land in favor of the foreign spouse as the right over the asset holder. The foreign spouse will receive the substitute title deed of the land and property in his/her name. The original title deed will almost be unusable as long as the right over asset exists. The right over asset can be sold, mortgaged, transferred, or inherited.

- Registering the right of usufruct over the property in favor of the foreign spouse. The right to live or gain benefit will belong to the foreign spouse as long as he/she is still alive. Unlike the right over asset, the right of usufruct cannot be sold, mortgaged, transferred, or inherited.

- Applying for the building permit in the foreign spouse’s name or registering the right of superficies in favor of the foreign spouse. As a result, the building or construction above and under the land will belong to the foreign spouse. The right of superficies will not void upon the destruction of the building. It can be transferred and inherited.

If possible, the foreign spouse must be registered in the house book (Tabien Baan) of the property, or the couple should obtain a yellow book specifically for foreigners.

Please note that many Thai people, especially in upcountry, live in big families warmly. Marrying a Thai spouse may be equal to marrying his/her family. So, please learn their culture & way of life before joining them.

5. Registering the Right of Usufruct

In Thailand, Usufruct is a legal registration, a part of the category real rights, and governed by sections 1417 to 1428 of Thai Civil Law. When the right of usufruct is registered over the land title deed with the home, villa, farm, or other construction on it, at the local land office. it could be more or less compared with the concept of a life estate. The usufructuary will gain the absolute management, all benefit and usage of the immovable property on the land. The right of usufruct is not transferable, but the usufructuary is allowed (unless restricted in the usufruct contract) to transfer the exercise of his right under the usufruct to another person. It ends at the death of the usufructuary.

Facts about usufruct

- The usufructuary cannot sell or consume the property.

- The substance of the property has to be keep unaltered (section 1424), therefore if the property is the empty land to be used for the building construction. Establishing the right over asset, or registering the right of superficies with the land lease agreement, would be more considerable options.

- The right of usufruct cannot be transferred, sold, or inherited. But the exercise of the right of usufruct can be transferred to another person.

- The right of usufruct will end at death of the usufructuary.

Registering the right of usufruct is often used to protect the residential & benefit right of a foreign spouse in the real estate property registered as a personal property of his/her Thai spouse. Whereas, for Thai family, many parents will register the right of usufruct over the property (mostly the house) while transferring the property to their children in order to make sure that they will not behave ungratefully to their parents after receiving the heritage before their death.

6. Registering the Right of Superficies

The right of superficies is a property right registered at the local land office, where the land is located, on the land title deed. By the registration, the right of superficies becomes a real right attached to the land in order to separate the ownership of the land, and anything (construction, building, farm, plants) above or under the land. Thus, the foreigner can register the right of superficies to own everything on or åin the land, whereas the land is owned by Thai citizen.

Superficies is called “droit de superficie” in the French, “Erbbaurecht” in Germany, and “recht van postal” in the Netherlands

Facts about superficies in Thai Law

- Unless otherwise provided in the act creating it, the right of superficies is transferable and transmissible by way of inheritance. (Section 1411)

- A right of superficies may be created either for a period of time or for life of the owner of the land or the superficiary. (Section 1412)

- The right of superficies may be terminated at any time by any partner giving reasonable notice to the other. But when rent is to be paid, either one year’s previous notice must be given or rent for one year paid. (Section 1413)

- If the superficiary fails to comply with essential conditions specified in the act creating superficies or, when rent is to be paid, he fails to pay it for two consecutive years, his right of superficies may be terminated. (Section 1414)

- The right of superficies is not extinguished by destruction of the buildings, structures or plantations even if caused by force majeure. (Section 1415)

7. Establish the RIGHT OVER (Leasehold) ASSET New!! Legally owning Land & Property in Thailand with the substitute Title Deed!! (RIGHTS OVER LEASEHOLD ASSET ACT B.E.2562)

For the foreigner, if your objective is to own the immovable property in Thailand with the right & official documents, likes the land title deed, that can be sold, transferred, inherited, and even be used, or even be mortgaged as your collateral for the financial institutions, creditors or lenders, Establishing the RIGHT OVER (LEASEHOLD) ASSET can be your considerable solution!!

According to the RIGHTS OVER LEASEHOLD ASSET ACT B.E. 2562 announced on April 2019, RIGHT OVER (LEASEHOLD) ASSET is the “property” considered as a new asset class that has the right in utilization of immovable property as prescribed in the Act.

The objective of this act is to promote the foreigner’s investment in Thai real estate being capable of extensively use over a long period of time. It is analogous to acquiring real estate ownership. And another objective is to reduce in using Thai Nominee (agent) to hold the property or the company’s share for the foreigner. (Yes, after announcing this ACT, the investigation will be done more frequently. If you are using the Thai Nominee, please consult our property lawyer to correct it legally in time!!)

.

The RIGHT OVER (LEASEHOLD) ASSET is not based on any foreign law. There is no criteria or condition that screens the right holders based on their status as foreigners in the Rights Over Leasehold Asset Act B.E. 2562. Thus, the foreigners can freely hold Rights Over Leasehold Asset based on their rights according to the Act. Unlike the Land Code and the Condominium Act, which require foreigners to acquire only a limited amount of real estate, the RIGHT OVER (LEASEHOLD) Asset is not covered by these two laws because it is not the same type of right as ownership or possession.

Upon establishing the RIGHT OVER (LEASEHOLD) ASSET, “the certificate of rights over leasehold asset” will be issued. Its function is almost equal to the title deed or strata title (the document of condo ownership—”Aor”Chor 2” in Thai) as the case may be. The RIGHT OVER (LEASEHOLD) ASSET holder has right, duty, and liability in the immovable property which it has been established rights over (leasehold) as if he is the owner of immovable property, except right to track and get immovable property back from a person who has no right to hold onto and right to obstruct another person not to interfere illegally with such immovable property. (Section 11)

The establishment of the RIGHT OVER (LEASEHOLD) ASSET is more firm and secure compared to those with general leasehold right under the lease agreement.RIGHT OVER (LEASEHOLD) ASSET can be transferred to each other or used as collateral by pledging to mortgage under the Civil and Commercial Code. Rights over leasehold asset can be inherited. (Section 12)

Term of the RIGHT OVER (LEASEHOLD) ASSET is not more than 30 years. The renewal can be done through the registration at the local land office, where the immovable property is. (Section 4)

Important Facts About the Right Over (Leasehold) Asset.

- The establishment of the RIGHT OVER (LEASEHOLD) ASSET can be activated with the immovable property—land that has title deed, land with structure in land that has title deed, and strata title condominium unit under the law on condominium (section 3)

- RIGHT OVER (LEASEHOLD) ASSET shall not be subdivided. (Section 8)

- A holder of RIGHT OVER (LEASEHOLD) ASSET has right to utilize immovable property. (Section 10) There is no need for the permission of the property owner in official business, ex. applying the building permit, asking for electricity & water meter, doing the plantation, etc.

- When establishment of the RIGHT OVER (LEASEHOLD) ASSET in any immovable property, owner of immovable property cannot establish any proprietary interest in such immovable property except receiving written form of consent from the holder of rights over leasehold asset. (Section 9)

- This will not affect the right in transferring ownership to another person, or using ownership in immovable property as pledge to mortgage or using as collateral under law on business security. This issues have to be mentioned in the agreement & contract in order to protect the right of the foreigner, or RIGHT OVER (LEASEHOLD) ASSET holder.

- The RIGHT OVER (LEASEHOLD) ASSET can be transferred to each other or used as collateral by pledging to mortgage under the Civil and Commercial Code. And the RIGHT OVER (LEASEHOLD) ASSET can be inherited. (Section 12)

Read more about “Right Over Leasehold Asset”: Getting to know “Right Over Leasehold Asset”

“RIGHT OVER (Leasehold) ASSET” vs Other Options for the Foreigner owning Thai Property

Want to Know more regarding the RIGHT OVER (LEASEHOLD) ASSET!! Please Contact us!!

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

Challenges in Buying & Owning Real Estate in Thailand

- The using Thai nominee (agent), holding your company’s share, or property, especially the land, is illegal in Thailand. The risks can be the enforcement to dispose of the land and the criminal penalties. The government investigation will be done randomly based on the source of funds, the nominee’s occupation and usual income. In some cases, the foreigners use the nominee involved in money laundering from other criminal offenses, e.g., drag, fraud, and ponyshare. These may cause your property to be seized and investigated and may lead to your arrest warrant in Thailand.

Some nominees have a lot of debt or even go bankrupt. This can also make your property be seized by the debtor or the financial institutions.

Please do not trust any irresponsible Thai lawyers, Property agents, Real estate developers, or anyone giving the nominee solution for you. “Many do this,” “Not (yet) having problems,” or “Others can do” do not mean that you will have no problem. Why should you rely on luck while there are many legal solutions??? - “Divorce” with your Thai spouse can lead to the difficulty in dividing the martial asset & property. The land will be your Thai spouse’s personal property. Since the land can only be legally owned by Thai national. Many foreigners lost their Thai house and a lot of money by the divorce. The prenuptial agreement the marriage can be a reasonable choice. Registering the right of usufruct, or establishing the Right over Asset can be a considerable solution to secure your house in Thailand.

- Each solution/registration, in order to own or invest in the property in Thailand, has different objectives & results, ex. for business investment, long-stay, or self-living. Many factors must be taken into account in order to fulfill your actual demand. For example, the right of usufruct will secure your living and benefit on the property, strongly, but it can not be transferred or inherited. Thus, its objective is for self-living, not business or for investment. Whereas, you want to invest in many properties, and to enjoy their benefits from sale-rent income. Setting up a company according with doing Long-lease agreement, or establishing the Right over Asset can be more interesting option to ease the tax issue, and currency transfer.

- Seeking reliable property lawyers, or consultants is one of the best recommendations to start your property investment journey in Thailand. But not much Thai licensed lawyers have direct experience in Real estate & property business. And according with foreigner group community claimed local experts, they sometimes make more problems than good.

Enforcement and Punishment Measures in Land Holding

as an Agent for a Foreigner

(originally published by the Thailand Land Department)

If it appears the fact last that there is the threat of land holding as an agent for a foreigner, the measures to the land disposal and the offender punishment shall be enforced as follows (source land department);

- Measures on land by enforcement to dispose of the land in accordance with legal procedures.

Under Section 94 and 96 of the Land Code, stipulate the regulation when it appears that the person who obtained the land as an agent for a foreigner or foreign entity or foreigner who obtained the land illegitimately, he/she shall dispose of such land in the portion of his/her possession within the period of time specified by the Director-General of the Department of Lands which shall be not less than one hundred eighty days and not more than one year. The Director-General shall have the power to dispose of such land if time limit elapses. - Measures on individuals with criminal offense and to be punished in accordance with laws.

In the case of applying for land registration as an agent for a foreigner, there will be a criminal offense as follows:

2.1) Offenses against the criminal code section 267 due to information the competent official to record a false statement in the official documents shall be subject to punishment with an imprisonment of not exceeding three years or a fine of not exceeding 6,000 baht or both.

2.2) Offenses against the land code act. The alien who commits the offenses under the land code section 111, due to the acquisition of land illegitimately, shall be subject to punishment with a fine of not exceeding 20,000 baht or an imprisonment of not exceeding two years or both. Juristic person who commits the offense under the Land Code Act, section 112, or section 113 in case of Thai people; due to the acquisition of land as the agent for a foreigner or foreign entity shall be subject to punishment with a fine of not exceeding 20,000 baht or imprisonment of not exceeding two years or both.

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!

Why should you hire “House & Condo Lawyer”

as your professional real estate lawyer in Thailand?

If you are looking to buy property in Thailand for living or investment, you will need Property lawyers who have knowledge & experience in local real estate business and laws. We provide you with a trustworthy consulting and services support team on both property legal service & real estate business.

House & Condo Lawyer consists of property lawyers and a real-estate business team with more than 15-year experience who are promptly to assist you at your extensive requirements. Because your goals are our achievements, you can rest assured that with our services, every one of your requirements will be attended to and responded to your best benefit with our sincere expert’s advice about the world of real estate business and property laws.

Our Services

- Property Living & Consultant in Thailand

- Property & Real Estate Legal Services (English Speaking)

- How to own / invest the real estate in Thailand, 100% Legally

- Due Diligence for Property Transaction : Buy – Sale – Rent etc.

- How to buy/invest “NPA Assets” of Financial institution (20-40% Cheaper below market price)

- Property / Real Estate Fraud Lawsuit in Thailand

- Escrow Account in Thailand for Real Estate & Property Purchase Transaction, or Lawsuit

- Thailand Visa & Immigration Services

- Refund Property Downpayment from the Property Developer in Thailand : Condominium Unfair Contract, Delay & Poor Construction, EIA not pass, or even change your mind not to buy!!

- Business Match Maker & Consultant : Experience & Expertise in Real-estate, Hotel, Information Technology (IT), Commercial & Medical Business

- Business Registration and Corporate Services

- Accounting & Tax Planning

- Relocation Service for Foreigners / Expats

- Family Legal Services: Marriage Registration. Prenuptial Agreement, Filing of Contested and Uncontested Divorce, etc.

- Last Will and Testament

- Notary Services

- Translation and Legalization Services

- Consumers Rights Protection Lawsuits

Our Lawyer Team

KANYAPAS TANTIVATANASATIEN

(LAWYER VIVIAN)

HEAD OF PROPERTY AND BUSINESS LAWYER

Lawyer Vivian brings over 15 years of hands-on experience in Thailand’s real estateandproperty agency sector, making her one of the most trusted legal advisors in this field. She has consistently provided professional legal consultation and representation to both domestic and international clients, with a particular focus on real estate transactions, land ownership, leasehold agreements, and development advisory across Thailand.

With her deep knowledge of Thai property laws and strong background in the practical aspects of the real estate business, Lawyer Vivian bridges the gap between legal requirements and real-world investment — ensuring her clients make well-informed, legally secure decisions.

Education & Qualifications

- LLB. Laws, Chulalongkorn University (Honor)

- M.P.P. Public Policy, University of Sydney, Australia

- B.A. Political Science, Chulalongkorn University (Honor)

- Certificate Secondary School, Belmont, MS.USA

- Certificate RE-CU, Interior Faculty, Chulalongkorn #27

- Attorney License (Thailand)

Areas of Legal Practice and Specialization

- Legal Consultation on real estate and property laws.

- Real Estate Business Contracting Specialist.

- Attorney-at-laws, on trustee and estate settlement.

- Property Transaction and Negotiation.

- Notarial Service Lawyer

- Foreigner Affair & Family Legal Service

- Thailand Visa & Immigration

Experiences

- Foreign Security committee to lead consultant of Deputy Prime Minister.

- Head of Business for corporate Real Estate /Property Agency .

- Property Consultation Australia and Thailand.

- Business Consultation for healthcare business groups.

- Legal Consultation on business and estate laws.

MONTIRA KIATSUNTHORN

(LAWYER PAM)

HEAD OF CRIMINAL LAWSUIT & PROPERTY LAW

Lawyer Montira is a highly experienced and respected Thai attorney specializing in corporate governance, compliance, and fraud litigation involving foreign clients in Thailand. With over a decade of legal practice across a range of industries — including real estate, investment, and international business — she is known for her ability to deliver clear, strategic legal advice and handle high-stakes contractualmatters with precision.

She has successfully advised numerous companies and investors on regulatory compliance, particularly with the Securities and Exchange Commission (SEC) and the Stock Exchange of Thailand (SET), helping clients navigate legal risks and maintain credibility in the Thai business landscape.

Education & Qualifications

- Master of Laws (LL.M. in International Trade Law) University of Essex, UK

- Bachelor of Laws (LL.B.) Faculty of Law, Thammasat University, Bangkok

- Attorney License (Thailand)

- Notarial Services Attorney License

Areas of Legal Practice and Specialization

- Criminal Offence Procedure from law enforcement level to court’s litigation

- Legal and Government Affairs

- Business Disputes Resolutions

- Listed company secretarial filing

- Real-Estate and Property lawsuits and transaction

Experiences – Head of Legal & Corporate Lawyer & Consultant

- KPN Groups

- Raimon Land Public Company Limited

- TOA Paint (Thailand) Public Company Limited

- Siam Makro Public Company Limited

- Pace Development Corporation Public Company Limited

- Ananda Development Public Company Limited

- PAE (Thailand) Public Company Limited

Montira@housecondolawyer.com

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

Contact us for more information!! Free Consultation for the First Time!!