NPA Property in Thailand: Invest and Buy Assets from Financial institutions (NPA) in Thailand, 20–40% Cheaper than the market price. Another wise solution to invest in is to buy property in Thailand as a foreigner, particularly in Bangkok, Pattaya, Phuket, Patong, Huahin, Chiang Mai, Udon Thani, Koh Samui, and Krabi.

Are you a foreigner dreaming of owning a house or real estate in Thailand? or Are you a foreign investor seeking lucrative opportunities in Thailand’s real estate market? The opportunity to purchase property through Non-performing Asset (NPA) properties presents an accessible and lucrative avenue for foreigners to realize their real estate aspirations in the Land of Smiles.

Non-Performing Assets (NPAs) offered by financial institutions present a unique chance to acquire properties at significant discounts, typically ranging from 20% to 40% below market prices. In this article, we explore why investing in NPAs could be a wise solution for foreigners looking to own property in Thailand.

Understanding Non-Performing Assets (NPAS) in Thailand

Non-Performing Assets (NPA) refer to loans or advances that have ceased to generate income for financial institutions. In Thailand, NPAs can arise due to various factors, including economic downturns, business failures, or inadequate risk management practices by lenders. These assets often undergo restructuring or recovery processes to minimize losses for lenders and maximize returns for investors.

Thus, Non-Performing Assets (NPAs) are properties seized by financial institutions due to loan defaults or non-payment by borrowers. These assets are often sold at discounted rates to recover outstanding debts. In Thailand, NPAs encompass a diverse range of properties, including residential homes, commercial buildings, land plots, and condominium units.

Legal Services for Investing & buying the NPA Property

Our Scope of work :

-

Negotiation with financial institutions or banks: price, conditions

-

Due Diligence for Property Transactions

-

Evaluate the risk involved (if there is any).

-

Checking the property’s status and condition

-

Escrow Account in Thailand for Real Estate and Property Purchase Transactions

-

Coordinate with the client, the land department, and the financial institution or bank.

-

Property Transaction Process for the Foreigner

-

Litigation, exercising court rights, and law enforcement.

-

Property Living Consultant and Lawyer

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law, with the Reasonable Fee & Expense (No Foreigner’s Expensiveness or Extra International Charge).

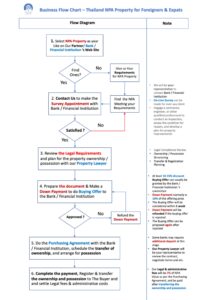

How to buy / Invest NPA Property

1) Select NPA Property as your Like on Our Partner/ Bank / Financial Institution ‘s Web Site that meets your requirement. You can choose the selected NPA Property from our partner, or any Thai financial Institutions / Banks.

2) Contact Us to make the Survey Appointment with Bank / Financial Institution We will be your representative to contact Bank / Financial Institution. On-Line Survey can be made for over-sea client.

3) Review the Legal Requirements and plan for the property ownership / possession The Legal Compliance will be reviewed regarding the NPA Property you choose as a foreigner/Expat. The structure of Ownership / Possession will be planned according to the Thai Law.

4) Prepare the document & Make a Down Payment to do Buying Offer to the Bank / Financial Institution At least 10-15% discount Buying Offer is usually issued to the Bank / Financial Institution ‘s committee, and they will consider within 1 week. We will be your representative to negotiate the price & term for you. In this process, Down Payment will be made normally at 10% of the offering price, and it will be refunded if the buying offer is rejected. Yes, the Buying Offer can be proposed again after that.

5) Do the Purchasing Agreement with the Bank / Financial Institution, schedule the transfer of ownership, and arrange for possession Upon the approval of the financial Institution / Bank, the Purchasing Agreement will be made. Our Property Lawyer will be your representative to review the contract, negotiate terms, doing the due diligence, checking the property status, or any possibility of Occupancy Disputes, and preparing the paper works with the land department & the financial Institution / Bank.

6) Complete the payment, Register & transfer the ownership and possession Property Transaction at the branch of Land department that the asset located. Our professional real-estate team will guide you through the process, and aiding you receiving the property.

Our Legal fees & administrative costs will be settled after transferring the ownership / possession of the property.

Option : Should you require, We are well-equipped to provide or undertake renovation and interior design services. Additionally, we can develop comprehensive management plans and oversee the leasing and administration of your property. (Please feel free to share your needs with our team during the property survey (2), or discuss with our property lawyer when reviewing the legal requirements (3).

Expenses for Purchasing NPA Properties

1. Property appraisal fee, which depends on the terms of each financial institutions.

2. Stamp duty fee of 0.05% of the purchase price.

3. Transfer fee of 2% of the official appraisal value.

4. Withholding tax and specific business tax (Normally, the seller will be responsible for these expenses)

5. Legal & administrative Fee to do the negotiation & Paper works with the financial institutions, Checking the status of the property or doing due diligence. Assessing the property condition and finding the supplier to do the renovation. Litigate, exercise court rights, and engage law enforcement (if needed)

Ready to embark on your journey to homeownership in Thailand? Contact us today to explore NPA property investment opportunities tailored to your needs and preferences.

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law,

Key Benefits of Investing in NPA Properties

1. Discounted Prices:

NPA properties are typically priced below their market value, offering investors significant discounts compared to conventional property investments. With discounts ranging from 20% to 40%, investors can acquire properties at a fraction of their actual worth or market price. (Normally, there are

30–50% discounts for Land, houses, villas, or land with construction, whereas there are 15–25% discounts for a condominium.)

2. Real Assets in Real Conditions:

Unlike the project under construction, speculative investments or paper assets, NPA properties provide tangible assets that you can see or assess based on their actual condition, rather than on dream-drawing paper or projections. This ensures that buyers are dealing with real properties in real conditions, allowing for a more accurate evaluation of the investment’s potential and risks.

By acquiring NPAs, buyers gain access to undervalued assets with the opportunity to unlock their true value through strategic management and rehabilitation efforts. In essence, buying NPA properties represents a pragmatic approach to real estate investment, grounded in the reality of property conditions and market dynamics rather than speculative assumptions. The moment you buy,

the more profit you gain.

3. Diverse Investment Options:

NPA properties encompass a wide range of real estate assets, including residential homes, commercial buildings, land parcels, and condominium units. This diversity allows investors to choose properties that align with their investment objectives and risk tolerance

4. Potential for High Returns:

Despite being distressed assets, NPA properties hold the potential for high returns on investment. With strategic renovations, repositioning, or rental income generation, investors can unlock the inherent value of NPA properties and realize substantial profits.

Challenges and Risks Associated with NPA Investing in Thailand

When considering investing in or buying non-performing asset (NPA) properties in Thailand, it’s essential to be aware of the potential risks and drawbacks. While NPAs offer attractive discounts, there are several factors to consider before making a purchase.

1. Occupancy Disputes:

One of the most significant challenges in purchasing NPA properties is dealing with occupants who refuse to leave the premises. These occupants may have legal rights or tenancy agreements that complicate the eviction process, leading to delays and additional legal expenses. Letting your Property Lawyer check the status of the property before the transaction can be a wise solution.

2. Limited Property Information :

One of the challenges of purchasing NPA properties is the limited information available about the property’s condition, legal status, and history. Unlike conventional real estate transactions, NPAs may lack comprehensive documentation, making it challenging to assess the property’s true value and potential risks.

3. Property Condition and Maintenance :

Many NPA properties are distressed or in poor condition due to neglect or lack of maintenance by previous owners. Investing in NPAs may require significant renovations or repairs, which can incur additional costs and delays. It’s essential to conduct thorough property inspections and assessments to determine the extent of the repairs needed before making a purchase.

4. Legal and Regulatory Risks :

Navigating the legal and regulatory aspects of NPA property acquisitions can be complex, especially for foreign investors. There may be uncertainties regarding property ownership rights, outstanding liens or encumbrances, and compliance with local laws and regulations. Engaging legal advisors with expertise in

real estate transactions in Thailand is crucial to mitigating legal risks and ensuring a smooth acquisition process.

Note: Technically, foreigners cannot own “land” in Thailand, but they can take ownership of a condominium unit upon Foreign Ownership Quota (49%). They can also take ownership of the house, building, or construction above the land. However, the foreigners can possess the land through other methods such as a long-term lease agreement, a right-over (leasehold) asset, a Thai company, a Thai spouse, the right of usufruct, and the right of superficies.

Click to See also: How to Invest / Buy / Own Thai house, Condo, Villa, Apartment, Property & Business in Thailand

Venturing into NPA property investments as a foreign national offers exciting opportunities, but it’s crucial to approach it with the right legal guidance. Partnering with an experienced real estate lawyer isn’t just a smart move—it’s your key to securing your investment and smoothly navigating the legal complexities. With our expert support, you can confidently move forward with your NPA property purchase, assured that your interests are fully protected at every step.

Ready to embark on your journey to homeownership in Thailand? Contact us today to explore NPA property investment opportunities tailored to your needs and preferences.

Our Legal Services

Investing in Non-Performing Assets (NPAs) in Thailand offers you a unique opportunity to acquire quality properties at discounted prices. With discounts of 20% to 40% below market rates, NPAs present an attractive alternative for investors seeking to diversify their real estate portfolios and maximize their returns. By leveraging expert advice, conducting thorough due diligence, and navigating the acquisition process diligently, foreign investors can unlock the potential of NPAs and achieve their investment objectives in the vibrant real estate market of Thailand.

HOUSE & CONDO LAWYER, Property Thai Licensed Lawyers, offer the solution(s) for you in order to purchase, invest, or “own” the house, Condo, Villa, Apartment, Property & Real Estate in Thailand, legally and be enforceable by Thai Law

Investing in Non-Performing Assets (NPAs) in Thailand offers you a unique opportunity to acquire quality properties at discounted prices. With discounts of 20% to 40% below market rates, NPAs present an attractive alternative for investors seeking to diversify their real estate portfolios and maximize their returns.

By leveraging expert advice, conducting thorough due diligence, and navigating the acquisition process diligently, foreign investors can unlock the potential of NPAs and achieve their investment objectives in the vibrant real estate market of Thailand.

Ready to embark on your journey to homeownership in Thailand?

Contact us today to explore NPA property investment opportunities tailored to your needs and preferences.